The benefits of donating publically traded securities instead of cash may be the savvy investor’s best kept secret. Since the elimination of the capital gains tax on securities donations in 2006, it has been the most tax-efficient way to support your community and reduce your tax bill. But how do you go about donating securities, and what charities can you give them to? The process is easier than you might think.

At CanadaHelps, our non-profit mission is to increase charitable giving in Canada. Part of how we achieve this is by providing an easy-to-use giving platform for donors, and the most affordable online donation and fundraising platform for charities, which includes the processing of securities donations. We’ve processed thousands of securities donations worth millions of dollars since 2007, and have dispersed the funds to charities as diverse as shelters, places of worship, arts schools, medical organizations, and animal rescues.

For donors, it means flexibility and options. With so many demands on donor dollars and so many worthy causes, it’s important for people to give to the organizations they care about the most. For some people, that may mean giving to a large cancer charity, and for others, it may mean giving to a local community group. For many people, it might mean giving to both.

On CanadaHelps.org, you can give to any of Canada’s 86,000 registered charities, big or small, and it’s as easy as filling out an online form and then authorizing your broker. Securities are transferred to CanadaHelps, subsequently sold, and the funds are sent to the charity – or charities – of your choice. If you own a large number of securities and aren’t prepared to donate the full value, you can still give a portion and cash-out the rest.

For charities, this levels the playing field and provides access to a revenue stream that may previously have been out of reach. Unlike a cash gift, donations of securities are often too complex and time-consuming for smaller charities to handle, so all but the largest organizations have traditionally been left out.

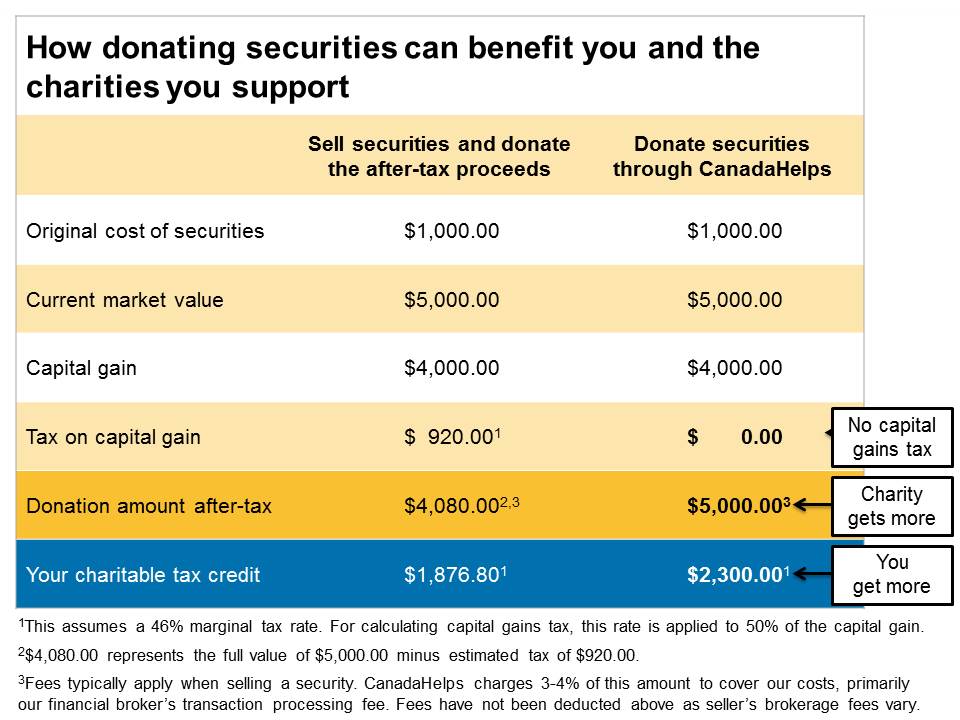

So just what are the tax benefits of donating securities instead of cash? Assuming your investments have appreciated in value and you sold them, you’d normally be assessed a capital gains tax. If you sold your investments and then donated the cash, you would receive the tax credit for the donation but would still have to pay tax on the gain – money that could have gone to a cause you care about. However, if you donated the securities directly to your charities of choice, you would receive a tax receipt for the full fair market value of your securities at the time of donation and pay no capital gains tax on the increase in value. Any excess tax credit can be carried forward up to 5 years. In the end, both you and the charities you support will come out ahead.

This giving season, stretch your giving dollars by donating securities through CanadaHelps instead of cash. You’ll save money on your tax bill, and help charities you feel passionate about at the same time.

Originally published in the Fall 2013 edition of “Your Guide to Charitable Giving & Estate Planning”

Leave a Reply